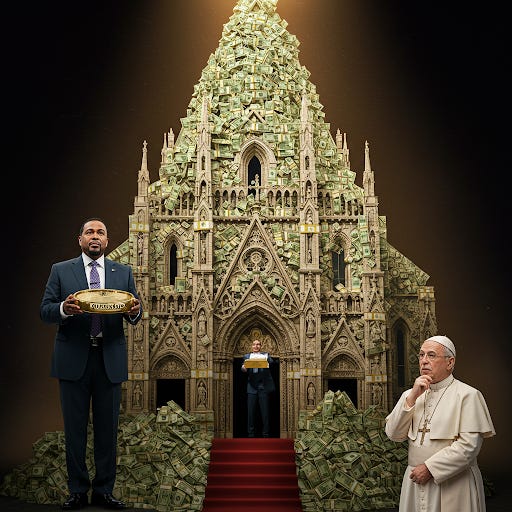

#Bristol - Holy Holdings: From Humble Beginnings to Billion-Dollar Empires. This is Twentieth-Century, Organised Religion.

Forget dusty sermons for a moment; we're talking big business with a divine twist!

The Vatican Bank Vault: More Than Just Holy Water

Let's kick things off with the granddaddy of them all: the Catholic Church. Picture this: a couple of millennia ago, a small band of followers gathered around a carpenter with some pretty radical ideas. Fast forward to today, and you've got a sprawling global organisation with more real estate than a Monopoly board on steroids.

Historically, the Catholic Church's journey from persecuted sect to powerful institution is a saga of shrewd political manoeuvring, strategic land acquisitions (often through "donations" that conveniently coincided with a one-way ticket to heaven, allegedly), and centuries of accumulating wealth. From the opulent Vatican City, a sovereign state nestled within Rome, to countless cathedrals, schools, hospitals, and investment portfolios worldwide, their assets are mind-boggling. Estimates vary wildly, but we're talking billions – if not hundreds of billions – in property and other holdings.

And at the helm of this spiritual and financial behemoth? The Pope. While his title, "Bishop of Rome," sounds rather pastoral, he's essentially the CEO of a multinational corporation with a unique selling proposition: salvation. He doesn't personally sign the cheques, of course, but his pronouncements carry immense weight, and the intricate financial machinery of the Vatican operates under his ultimate authority.

Now, about those tax exemptions. Ah, the sweet sound of no tax bills! In many countries, the Catholic Church enjoys significant tax breaks on its religious and charitable activities. This can include everything from property taxes on churches to income tax on donations. The argument, of course, is that their work benefits society through spiritual guidance, education, and charitable endeavours. Critics, however, point to the sheer scale of their wealth and question whether such extensive exemptions are entirely justified. After all, a billion-dollar property portfolio throws a rather long shadow.

Crown Jewels and Heavenly Dividends: The Church of England's Estate.

Across the (still holy) Channel, we have the Church of England. Born from a rather dramatic split involving a king who really, really wanted a divorce, the Church of England also boasts a fascinating historical trajectory. Once the state religion with significant land ownership and political clout, it has evolved (somewhat) while still retaining considerable assets.

Think grand cathedrals that have witnessed centuries of history, sprawling estates passed down through generations, and investments managed by savvy financial teams. While perhaps not on the same scale as the Catholic Church's global empire, the Church of England's portfolio is nothing to sniff at, running into the billions of pounds.

The spiritual and administrative leader here is the Archbishop of Canterbury. While the monarch holds the title of Supreme Governor, the Archbishop is the spiritual head, a sort of chairman of the board overseeing the Church's operations. Again, while not directly involved in day-to-day financial decisions, their leadership shapes the overall direction of this wealthy institution.

Similar to its Catholic counterpart, the Church of England benefits from various tax exemptions, again based on its charitable and religious status. This allows them to maintain their historic buildings, fund their ministry, and support community initiatives. The debate about the fairness and extent of these exemptions continues, especially when considering the value of their holdings.

American Gospelpreneurs: When Faith Pays for First-Class.

Now, let's hop across the pond and dive into the dazzling world of self-styled American evangelists. These aren't your traditional denominations with centuries of history and intricate bureaucratic structures. Instead, we're talking about charismatic individuals who have built massive followings and, shall we say, prosperous ministries.

Think of the televangelists with their slick productions, the mega-church pastors with their stadium-sized congregations, and the authors whose self-help books with a spiritual twist fly off the shelves. While they might not have the ancient land holdings of the Catholic Church or the Church of England, they've mastered a different kind of asset accumulation: the direct appeal to their followers' wallets.

We're talking about multi-millionaire lifestyles funded by donations, book sales, speaking fees, and various other ventures. Private aeroplanes make those coast-to-coast prayer meetings a breeze. Luxury homes ensure a comfortable place to contemplate divine mysteries (and perhaps the latest stock market trends). And yes, the glint of a Rolex peeking out from under a tailored suit has become something of a trademark for some.

These "gospelpreneurs" often preach a "prosperity gospel," the idea that God wants his followers to be wealthy and healthy. Generous donations, therefore, are not just acts of faith but also investments in one's own earthly and heavenly rewards. Critics, however, see this as a thinly veiled justification for extravagant lifestyles funded by the often-modest contributions of their flock.

While traditional religious organisations often have clearer lines of accountability and oversight (though not always without controversy), the financial structures of these individual ministries can be less transparent. Tax exemptions also apply to many religious organisations in the US, allowing these wealthy individuals and their ministries to operate without the same tax burdens as for-profit entities. This fuels ongoing debates about the definition of "religious activity" and the appropriate level of financial scrutiny.

The Bottom Line: Faith, Finances, and a Few Raised Eyebrows.

From the ancient accumulation of land and wealth by established churches to the modern-day prosperity of self-proclaimed prophets, the intersection of faith and finance is a complex and often fascinating one. While the stated aims are often spiritual and charitable, the sheer scale of the assets involved inevitably raises questions about accountability, transparency, and the true cost of those tax exemptions.

So, the next time you see a grand cathedral or hear about a televangelist's latest acquisition, remember that behind the spiritual pronouncements, there's often a multi-million (or billion!) dollar operation at play. It's a reminder that even in matters of the divine, earthly riches can be surprisingly close at hand.