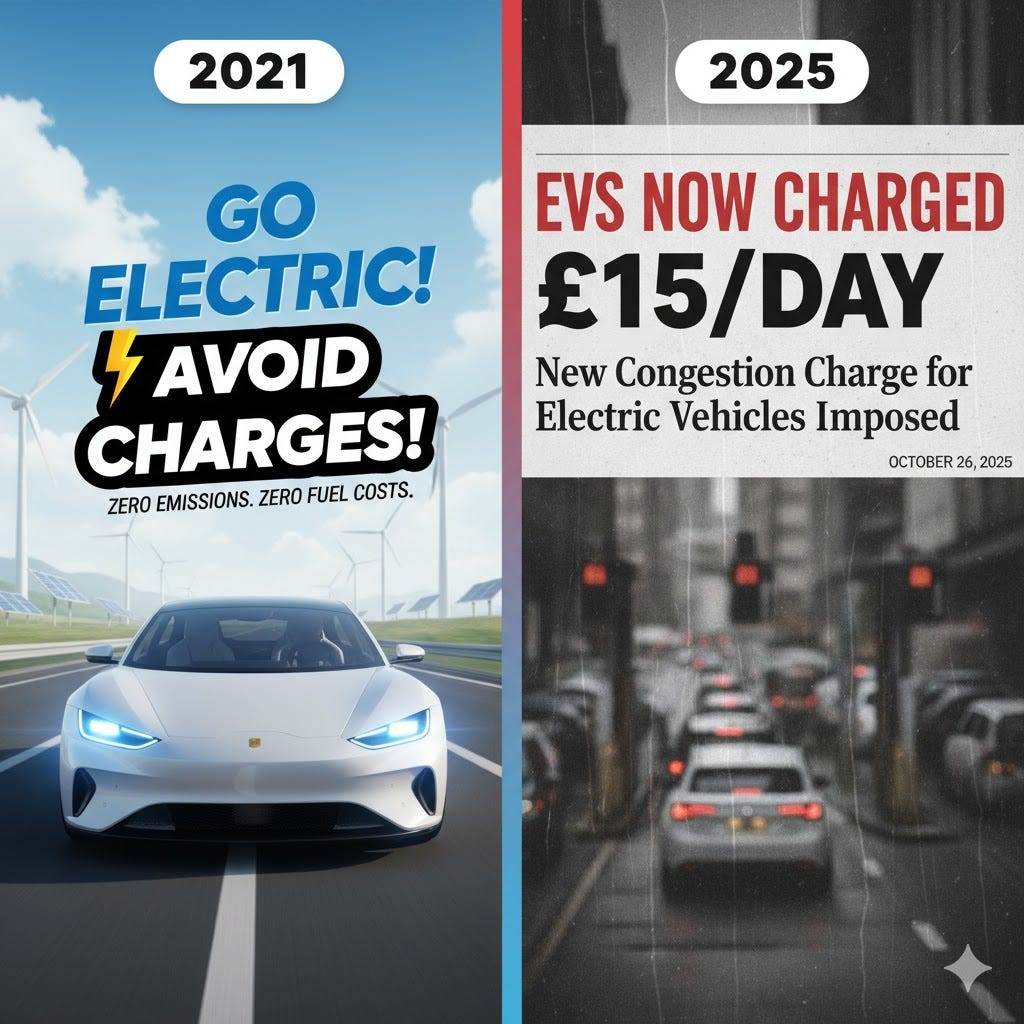

The Electric Vehicle Scam: How British Cities Championed EVs Then Penalised the Drivers Who Believed Them.

They Promised Exemptions. Now You Pay £15 Daily.

Bottom Line Up Front: British cities spent years championing electric vehicles with exemptions and incentives. Now that drivers have switched in good faith, those same authorities are systematically removing every benefit and adding new charges. London hits EV drivers with £15 daily congestion charges from Christmas Day 2025, Bristol is hiking Clean Air Zone fees by up to 55%, and the UK government is planning a 3p-per-mile tax by 2028. This was never about the environment. It was always about revenue.

The Bait: “Go Electric, Save the Planet!”

When cities positioned EVs as the solution to urban pollution, it was the entire justification for Clean Air Zones and congestion charges.

Bristol brought in its Class D Clean Air Zone in November 2022, charging older vehicles £9 daily. Electric vehicles? Completely exempt. London’s Sadiq Khan introduced the Cleaner Vehicle Discount in 2021, allowing EV drivers to pay just £10 annually instead of £15 daily.

And it worked. Between 2019 and 2024, vehicles registered for London’s discount jumped from 20,000 to over 112,000. People made significant financial commitments based on promised incentives.

The Switch: “Actually, You’re the Problem Now.”

Now that drivers have actually switched, local authorities have suddenly discovered that electric vehicles are somehow also a problem.

London: The £15-a-Day Christmas “Gift.”

On Christmas Day 2025, Transport for London will end the Cleaner Vehicle Discount entirely. Those 112,000 EV drivers paying £10 annually? They’ll now pay the full £15 daily congestion charge—£3,900 per year for daily commuters.

Plus the £195 annual road tax that EVs started paying in April 2025. Plus the proposed 3p-per-mile tax expected from 2028, adding another £250-360 annually.

Transport for London’s justification? They claim it’s necessary to “maintain the effectiveness of the Congestion Charge”. Which is fascinating: if electric vehicles contribute to congestion, they always did. The pollution was never the actual problem being solved.

AA president Edmund King called it “a backward step which sadly will backfire on air quality in London.” Translation: removing incentives the moment people respond guarantees nobody will trust future incentives. Why would they?

Bristol: The Green Party Reality.

Bristol’s story is even more instructive—the city is run by the Green Party, the people who are supposed to really believe in environmental priorities.

The Clean Air Zone brought in £31.2 million in its first year. Now Bristol is considering raising charges from £9 to £14—a 55% increase.

Read that again. The charges are working too well. People changed their behaviour, which means less revenue, which means charges need increasing.

Bristol faces a £52 million funding gap, and officers are seeking permission to raise fees to plug that hole. They openly admit the increase will bring £200,000 annually but generate zero net gain long-term as compliance increases.

This is your Green Party council. When they govern, they sound like every other cash-strapped authority squeezing money from available sources—including people who switched because they encouraged it.

The National Pattern.

At the national level, the Treasury faces losing £25 billion in annual fuel duty as drivers switch to electric. With 1.3 million EVs now on UK roads and six million projected by 2028, they face a £7-30 billion shortfall by 2030.

The solution? A 3p-per-mile tax on EVs expected in November’s Budget, potentially raising £1.8 billion annually by 2031.

The environmental benefits haven’t changed. What’s changed is that people responded to incentives, and now the revenue models don’t work.

The Cynicism Test.

Imagine if Khan had said in 2021: “This exemption lasts until December 2025. Plan accordingly.” Or if Bristol had announced: “EVs are initially exempt, but we reserve the right to charge them when our budget requires it.”

The honesty would have been refreshing. It also would have resulted in far fewer people switching. So they weren’t honest. They created the impression of lasting benefits when it was always a four-year promotional offer.

Self-Sabotage at Scale.

Here’s the darkly hilarious part: this approach actively undermines the environmental goals it supposedly serves.

The UK has legally binding commitments to reach net-zero by 2050, requiring 80% EV sales by 2030. But introducing a pay-per-mile tax in 2028 will “hit consumer confidence, causing future crashes”.

The government is legally bound to reach net-zero, has mandated EV adoption to achieve it, but is actively discouraging that adoption. The biggest loser will be the government when it faces legal action for failing its own climate commitments.

The Bottom Line.

Every electric vehicle represents lost fuel duty and congestion revenue. That was always true. What’s changed is that people believed them and responded accordingly.

From January 2026, London EV drivers pay £15-18 daily. Bristol drivers might pay £14. By 2028, all UK EV drivers face an additional 3p per mile plus £195 annual road tax.

The 112,000 drivers who believed Khan? They just learned “reward” meant “temporary promotional offer, all benefits withdrawn when convenient.”

This wasn’t incompetence or policy evolution. It was institutions prioritising revenue over everything else, using environmental language to disguise financial motives, and betraying people who believed them the moment it became fiscally convenient.

Welcome to British governance in 2025, where the only thing greener than the environmental commitments is the revenue stream they were designed to protect.